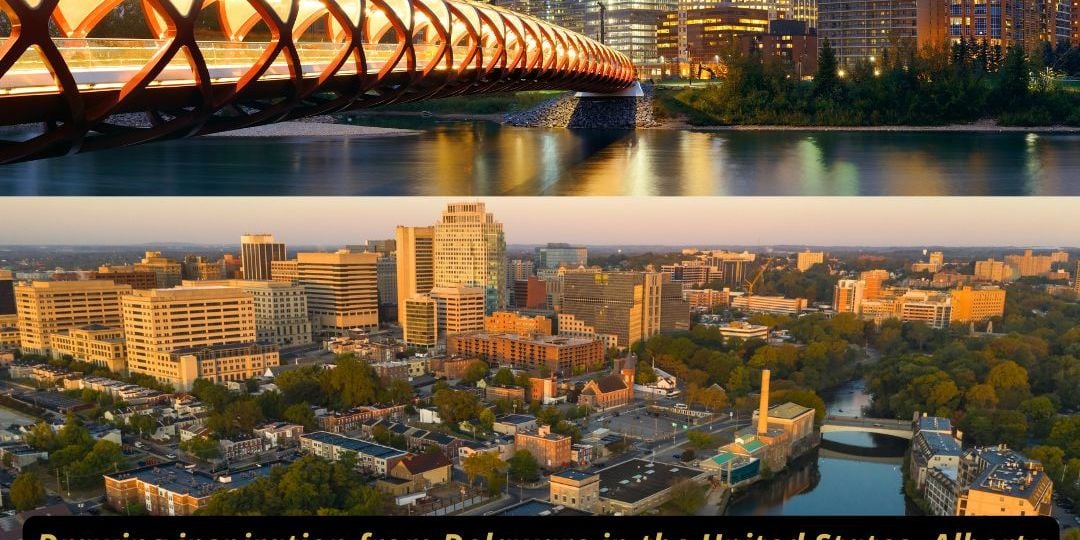

Why Alberta is Canada’s Delaware North, the best place to incorporate in Canada

When it comes to incorporating a business in Canada, many entrepreneurs and investors default to either their local provincial statutes or the federal Canada Business Corporations Act (CBCA). But in recent years, Alberta has quietly positioned itself as the best jurisdiction for incorporation in Canada—particularly for businesses looking to attract venture capital and private equity investments. Drawing inspiration from Delaware in the United States, Alberta is striving to become the Canadian equivalent of Delaware, becoming, as one could say, a “Delaware North”

Alberta’s Strategic Amendments: Attracting Sophisticated Investors

One of the most compelling reasons to incorporate in Alberta today is recent amendments to the Alberta Business Corporations Act (ABCA), designed specifically to appeal to venture capital and private equity investors. Just as Delaware has become the go-to jurisdiction for U.S. corporations due to its investor-friendly corporate governance rules, Alberta is making itself a similarly attractive option north of the border.

Alberta’s new amendments bring a higher degree of flexibility and investor control over corporate governance. This makes the province an ideal choice for startups and companies that are seeking sophisticated funding sources. Investors, particularly in venture capital and private equity, often prefer a jurisdiction where they can negotiate corporate governance terms, manage conflict of interest risks, and reduce legal liabilities. Alberta now offers that level of flexibility, giving it a leg up over other Canadian provinces and the federal option.

Key Features: Why Alberta Stands Out

Several key features in Alberta’s business law mirror the advantages that Delaware offers to corporations in the U.S.:

Corporate Opportunity Waivers: These waivers allow companies to limit certain conflicts of interest for directors and officers. By loosening restrictions on conflicts, Alberta facilitates smoother deal-making while reducing litigation risks for investors.

Director Indemnification: Alberta’s laws allow companies to offer greater legal protection to their directors, a crucial factor for attracting high-level talent to boards. Companies can indemnify directors from potential legal liabilities related to their corporate role, making it easier to attract seasoned executives and investors who often sit on boards.

Nominee Directors: Alberta permits directors appointed by investors (nominee directors) to prioritize the interests of the shareholder who nominated them. This alignment of interests between investors and the company ensures smoother decision-making at the board level and greater trust from venture capital and private equity investors.

These investor-friendly provisions make Alberta a particularly attractive jurisdiction for fundraising. Founders of companies outside of Alberta can also benefit by continuing their corporation into Alberta as part of a broader strategy to attract capital.;

Incorporating federally under the CBCA has become less attractive with the Canadian Government’s requirement requiring disclosure of individuals with “significant control”, a requirement which is not going to be investor-friendly in a world where investors would prefer to, in many cases, keep their investments discreet.

Why Alberta is “Delaware North”

Alberta’s move to enhance its corporate statute represents a significant shift in Canada’s corporate landscape. Traditionally, most provinces in Canada have adopted laws similar to the CBCA, with little variation between jurisdictions. Alberta’s amendments break from this trend and create a competitive advantage, marking the start of what could be a new era of competition between Canadian provinces.

This move makes Alberta similar to Delaware in several important ways:

Corporate Governance Flexibility: Delaware’s success in the U.S. is largely due to its permissive approach to corporate governance, allowing for “private ordering,” or the ability to set internal corporate rules as the company and its investors see fit. Alberta’s amendments now offer similar flexibility, particularly around investor protections and director liability.

Nationwide Impact: Just as a U.S. company can choose to incorporate in Delaware while conducting business nationwide, any Canadian company-regardless of physical location-can incorporate in Alberta and benefit from its investor-friendly corporate laws. This makes Alberta’s advantages accessible to startups and businesses across Canada, not just those headquartered in the province

A Boost for Startups and Investors Alike

Alberta’s enhanced corporate statute is not just a win for investors—it’s also a major advantage for entrepreneurs. Founders looking to raise capital can now incorporate in Alberta to attract venture capital and private equity investors, even if their business is based elsewhere in Canada. By adopting Alberta’s corporate opportunity waivers and offering enhanced indemnification for directors, founders can make their companies more attractive to investors without needing to move their operations physically to Alberta.

This development is particularly valuable in Canada, where competition among jurisdictions has traditionally been low. In contrast to the U.S., where Delaware has been the go-to for decades, Canadian founders have typically chosen local or federal statutes with little thought to jurisdictional advantages. Alberta’s efforts mark the beginning of real corporate statute competition in Canada, and founders and investors alike should take note.

The Future of Incorporation in Canada

As Alberta continues to enhance its corporate governance laws, the province may very well become the jurisdiction of choice for businesses across Canada, much like Delaware is in the U.S. The ability to tailor corporate governance to the needs of sophisticated investors, while offering valuable protections to directors, sets Alberta apart from the rest of the country.

Incorporating in Alberta offers businesses a unique opportunity to position themselves for success in attracting the capital they need to grow, while also benefiting from a legal framework that reduces risks for investors. Whether you’re a startup founder looking for venture funding or an investor seeking greater control and protection, Alberta is the province where your business should incorporate.

A missing piece of the puzzle will likely be Alberta developing a court system that accommodates and develops caselaw specifically addressing the needs of corporations, whether it be shareholder oppression or corporate governance disputes, Alberta needs to invest in a judiciary that can specifically address corporate law disputes if Alberta truly aspires to reach the same level of unanimity as the incorporation destination of choice in Canada as with Delaware in the United States.

In conclusion, Alberta’s aim to become Canada’s Delaware is not just a marketing pitch—it’s backed by meaningful changes in corporate law that provide real benefits to both founders and investors. With these strategic amendments, Alberta is positioning itself as the best province in Canada for incorporation, offering flexibility, protection, and a competitive edge that’s hard to beat.

Contact Alberta Business Corporate Commercial Lawyers

Author: Daniel Herman